About The Ghana Petroleum Funds

1. Introduction

The Petroleum Revenue Management Act (2015), Act 893 as amended provides the framework for the collection, allocation and management of petroleum revenue in a responsible, accountable and transparent manner. It aims to regulate the collection, allocation and management of petroleum revenue derived from upstream and midstream petroleum operations. The PRMA established four (4) funds namely the Petroleum Holding Fund, the Ghana Stabilisation Fund, the Ghana Heritage Fund and the Ghana Petroleum Wealth Fund over which Section 26, of the PRMA entrusts the Bank of Ghana with day-to-day operational management of the Fund.

2. The Petroleum Holding Fund

The Petroleum Holding Fund (PHF) is established under Section 2 of the PRMA, as the designated public fund at the Bank of Ghana to receive and disburse petroleum revenue due the Republic of Ghana. The PHF is held offshore at the Federal Reserve Bank of New York as the Bank of Ghana Petroleum Holding Fund Account. The gross receipts into the Petroleum Holding Fund are made up of the following:

- • Royalties from oil and gas, surface rentals and other receipts from petroleum operations and sale or export of petroleum

- • Receipts from direct and indirect participation in petroleum operations by the government

- • Corporate income taxes from upstream and midstream petroleum companies

- • Any amount payable by the national oil company as corporate income tax, royalty, dividends, or

- • Any other amount due in accordance with the laws of Ghana

- • Any amount received by government such as capital gains tax derived from the sale of ownership of exploration, development and production rights.

- • Production and signature bonuses

- • Additional oil entitlements

3. Ghana Petroleum Funds

Section 9 of the PRMA established the Ghana Stabilisation Fund (GSF) whilst the Ghana Heritage Fund (GHF) is established under Section 10. These two funds are collectively referred to as the Ghana Petroleum Funds (GPFs).

The purpose of the GSF is to cushion the impact on or sustain public expenditure capacity during periods of unanticipated petroleum revenue shortfalls. The Ghana Heritage Fund is to support development for future generations when the petroleum reserves have been depleted.

The GSF and GHF have important differences in their investment objectives. GSF is a fiscal stabilization fund with a short investment horizon and the investments are highly liquid and conservative to be able to meet unanticipated withdrawals. GHF is a savings fund to create wealth for future Ghanaian generations with a long investment horizon, the ability to take more risk and benefit from illiquidity premium.

4. Ghana Petroleum Wealth Fund

The Ghana Petroleum Wealth Fund (GPWF) is established under Section 20 of the PRMA. Within a year following the depletion of petroleum reserves the assets held in GSF and GHF would be consolidated into one fund; the GPWF, after which GSF and GHF shall cease to exist.

5. Distribution of Petroleum Revenue

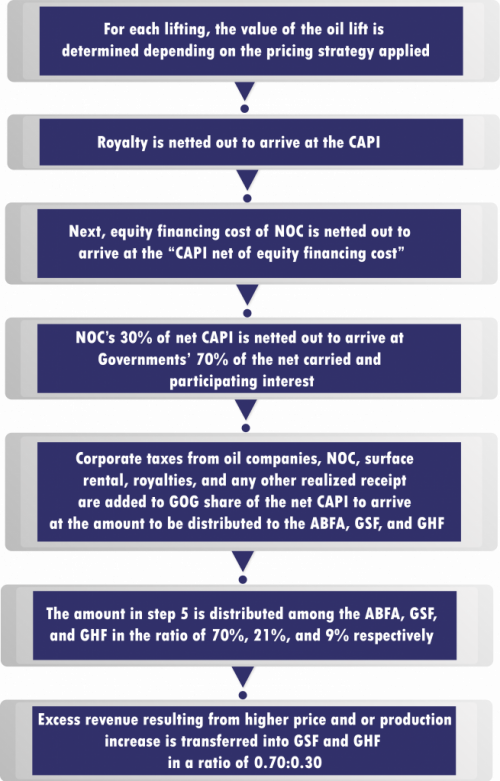

Petroleum Revenue received from all eligible sources is first placed in the Petroleum Holding Fund. Section 16 of the PRMA stipulates that disbursements can only be made from the Petroleum Holding Fund to a national oil company (NOC), the Consolidated Fund (Annual Budget Funding Amount (ABFA), the Ghana Petroleum Funds, and for exceptional purposes as defined by the PRMA. The diagram below details the process for the distribution of petroleum revenue from the Petroleum Holding Fund.